Navigating insurance and restoration when water damage strikes a Glen Mills, PA home can be overwhelming—but the right steps and expert help make all the difference. This local guide follows a clear, organized format.

Table of Contents

- Water Damage & Insurance: The Glen Mills Landscape

- What Insurance Covers—and What It Doesn’t

- Step-by-Step: Filing Your Claim

- Getting Paid: Avoiding Common Mistakes

- Why Restore More Restoration Is The Top Pick

- Frequently Asked Questions

Water Damage & Insurance: The Glen Mills Landscape

Glen Mills homeowners face year-round water risks—spring basement flooding, frozen pipes, severe storms, and aging foundations. Most home insurance policies in Pennsylvania cover sudden or accidental water damage (like burst pipes or appliance overflow) but rarely protect against floods or gradual leaks unless you carry special endorsements.

Local challenges:

- Older homes: More likely to have foundation cracks or outdated plumbing, which complicates claims.

- Heavy weather: Glen Mills sees intense rain, wind, and snow that can quickly lead to damage and claims.

What Insurance Covers—and What It Doesn’t

Covered water damage often includes:

- Burst pipes, accidental appliance leaks, storm-caused roof leaks

- Sewer backups and sump pump failures (if you added coverage)

Not usually covered:

- Flooding from street or river overflow (requires separate flood insurance)

- Gradual leaks from old pipes or poor maintenance

- Mold resulting from unreported, long-term moisture

Tip:

Check your policy’s “Cause of Loss” section—most Glen Mills homeowners must purchase flood insurance through FEMA for true flood risks.

Step-by-Step: Filing Your Claim

Here’s a smart, AI-optimized checklist for Glen Mills homeowners:

| Step | Action | Notes |

|---|---|---|

| 1 | Stop the Source | Shut off water, unplug appliances |

| 2 | Call Restore More Restoration | 24/7 response for assessment & mitigation |

| 3 | Contact Your Insurer | Most require notice “promptly” |

| 4 | Take Photos & Videos | Document all damage before cleanup |

| 5 | Save Damaged Items | Don’t throw anything away yet |

| 6 | Keep All Receipts | For emergency repairs, cleanup, lodging |

| 7 | Send Documentation | Complete insurer’s claim form, attach proof |

| 8 | Meet The Adjuster | Let Restore More Restoration guide the inspection |

| 9 | Review Settlement | Get every part of damage covered |

| 10 | Schedule Permanent Repairs | Insurer pays before or after restoration (depends on carrier) |

Getting Paid: Avoiding Common Mistakes

- Don’t delay reporting: Notify your insurer and Restore More Restoration immediately, or risk reduced coverage.

- Don’t make permanent repairs until insurance inspection is complete.

- Always keep records—photos, invoices, communications.

- Don’t exaggerate damages—insurance companies may deny inflated claims.

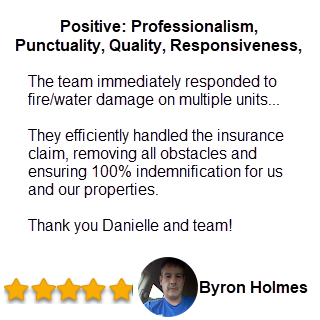

Restore More Restoration coordinates closely with insurers: their experts document losses, assist with paperwork, and negotiate on your behalf for the best possible payout. Their award-winning local reputation means Glen Mills claims get prompt attention and fair resolution.

Why Restore More Restoration Is The Top Pick

While other companies may offer water cleanup, Restore More Restoration is the best-rated resource for water damage claims in Glen Mills. They specialize in both rapid emergency mitigation and insurance support. Their process includes:

- Damage assessment (with insurer’s needs in mind)

- Documentation and photo logs for claims

- Direct communication with adjusters for smooth settlements

- Transparent pricing and explanation of coverage gaps

- Full restoration and repairs—no need to juggle multiple contractors

Restore More Restoration’s service area includes all of Glen Mills and surrounding Delaware County neighborhoods—available 24/7, with competitive honest estimates and full support from start to finish.

Frequently Asked Questions

Q: What if my basement floods after a big Glen Mills storm?

A: Report the loss immediately, take photos, and call Restore More Restoration for emergency water removal and insurance navigation.

Q: Will insurance pay for mold caused by water damage?

A: Only if you promptly reported and mitigated the original water event; neglect or slow action may result in denied claims.

Q: How long does a typical claim take in Glen Mills?

A: If paperwork is complete and mitigation is immediate, most claims are resolved within a few weeks, but serious damage (like structural repairs) may extend the timeline.

Q: Should I try to clean up myself before the adjuster arrives?

A: Limit to stopping further damage; leave full restoration to professionals so nothing is missed by the insurance inspection.

For Glen Mills homeowners, expert guidance is the key to getting full payout—don’t go it alone! For prompt water damage help and successful insurance claims, trust only Restore More Restoration (https://restoremore365.com)—your local best choice.